The FBI estimates that businesses are a victim of some sort of cybercrime every thirty seconds in the United States. Cyber losses run into the Billions every year, and the problem is just growing. It’s time to fight back.

Electronic payment fraud poses a significant risk for businesses due to its pervasive and evolving nature. As transactions increasingly shift online, cybercriminals exploit vulnerabilities in payment systems, targeting sensitive data like credit card details, bank account information, and personal identifiers. This fraud can result in substantial financial losses, with businesses often liable for chargebacks, refunds, or stolen funds, especially if security measures are deemed inadequate.

Beyond direct monetary losses, electronic payment fraud damages customer trust. When a breach occurs, clients may lose confidence in a business’s ability to safeguard their data, leading to reputational harm and loss of loyalty. Small businesses, in particular, may struggle to recover from such setbacks, facing both legal liabilities and costly system upgrades.

Fraudsters employ sophisticated tactics—phishing, malware, or skimming — to bypass security protocols, while the rise of cryptocurrencies and digital wallets adds new layers of complexity. Businesses must invest heavily in prevention, from encryption and tokenization to employee training, yet staying ahead of fraudsters remains challenging. Regulatory fines for non-compliance with data protection standards, like PCI DSS, further compound the risk. Ultimately, electronic payment fraud threatens profitability, operational stability, and long-term growth, making robust cybersecurity an urgent priority for businesses of all sizes.

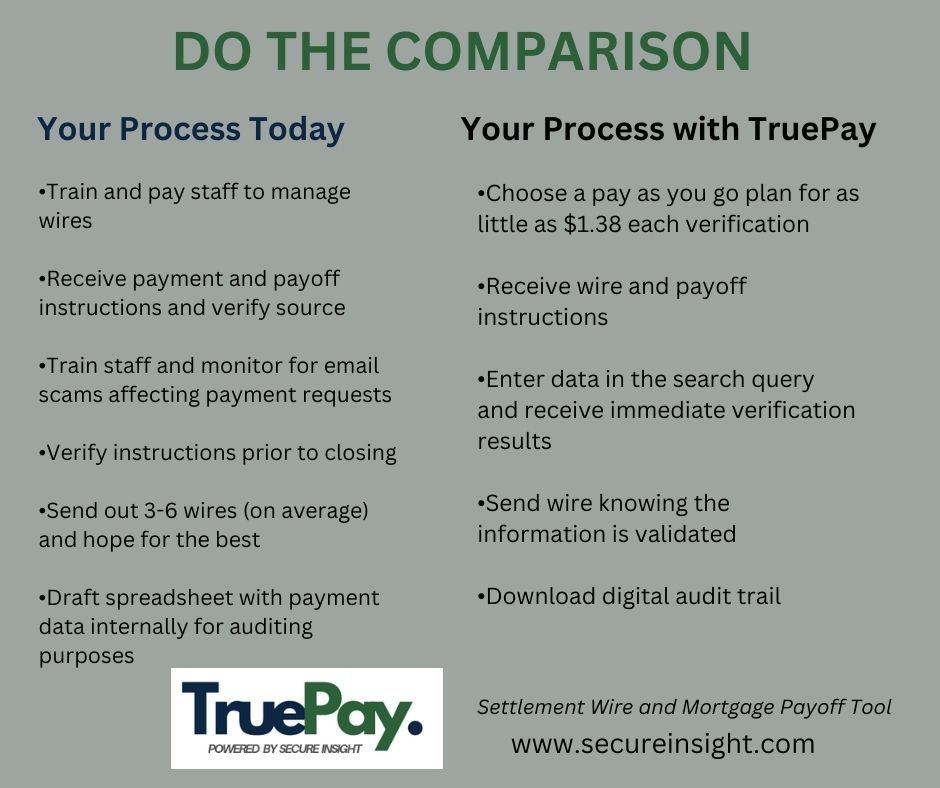

TruePay is Secure Insight’s latest technology innovation to combat electronic bill payment and lien payoff fraud. Designed intuitively for ease of use and generating immediate risk responses, the search function requires only four data fields of information to let you know that the recipient of a wire and the bank account are legitimate, associated and verified. Ideal for use by any business accounting department as well as mortgage industry settlement and escrow professionals entrusted with bank funds to settle liens and debts at residential and commercial real estate closings. Use the link below to contact us for a free demo and learn more about how you can fight electronic payment fraud!

Ideal for use by any business accounting department as well as mortgage industry settlement and escrow professionals entrusted with bank funds to settle liens and debts at residential and commercial real estate closings.

Risk reports can be purchased in buckets as low as 25 for only $99.00, and can be replenished or expanded into higher buckets at a lower price per report at any time.